ДОПОЛНЕНИЕ от 2 февраля 2021: Year-end report summary.

ДОПОЛНЕНИЕ от 2 февраля 2021: Year-end report summary.

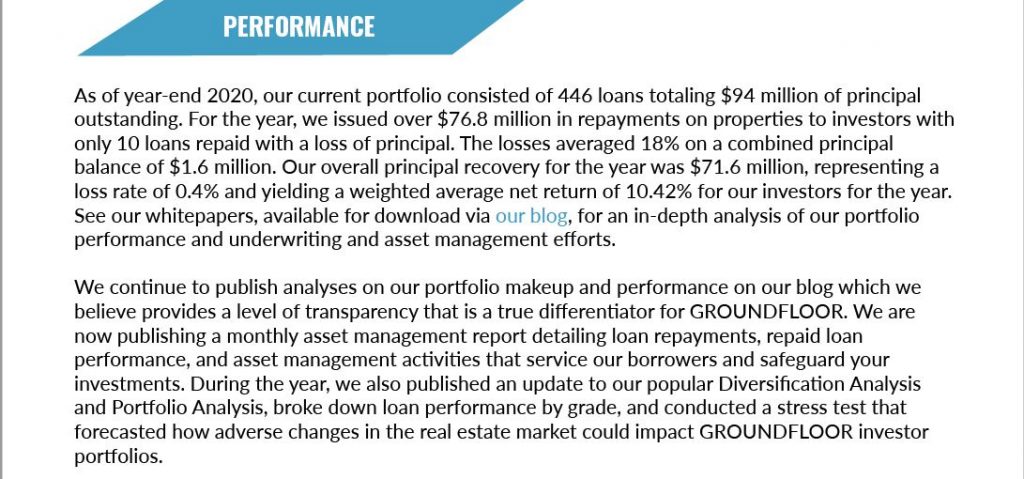

Today Groundfloor shared Shareholder-exclusive year-end report. It provides a more in-depth view of our performance for the full year 2020, as well as a preliminary outlook for this upcoming year. Here are a few highlights:

- We recorded a total of $145 million in investments for the year, a 50% increase over 2019, despite the uncertainty and turbulence in public markets.

- We raised a total of $4 million in equity capital, validating our most recent valuation of $73.9 million (a 43% increase over our 2019 valuation).

- Loans repaid during the year produced a return of 10.42% while GROUNDFLOOR Notes paid out rates up to 10% for a 12-month term.

- We shut down our institutional partner program and pivoted to run 100% on individual investor capital.

The company is enjoying incredible momentum as it enters 2021. Demand for our investing products is more robust than ever. Our lending pipeline is healthy and loan origination growth is accelerating. After more than doubling our production in each of Q3 and Q4, January came in with 61 units closed, surpassing the year-ago period for the first time since March. Meanwhile, our continuing equity raise is enabling us to press ahead to invest in our future with even greater confidence.

ДОПОЛНЕНИЕ от 31 августа 2020: финансовые результаты за Q2 2020

With the second quarter of 2020 now well behind us, in this quarter’s update, we are taking an opportunity to reflect on how well we have fared thus far through the COVID-19 pandemic. Despite the global financial crisis, our investment platform continued to grow. Investors showed a strong conviction about GROUNDFLOOR’s viability and value as an alternative to public investment options. In fact, we ended the quarter with a record $33.3 million and set monthly investment records in both May and June, and led off Q3 with another record month in July.

With the second quarter of 2020 now well behind us, in this quarter’s update, we are taking an opportunity to reflect on how well we have fared thus far through the COVID-19 pandemic. Despite the global financial crisis, our investment platform continued to grow. Investors showed a strong conviction about GROUNDFLOOR’s viability and value as an alternative to public investment options. In fact, we ended the quarter with a record $33.3 million and set monthly investment records in both May and June, and led off Q3 with another record month in July.

As expected, the lending portion of our business, our primary source of revenue, was materially impacted by the economic and social effects of the pandemic. As we communicated in our Q1 Shareholder update, we opted to manage risk by establishing interim lending guidelines and temporarily pulling back on the lending volume. While our non-GAAP revenue declined to $740K for the quarter, we have already started to ramp up our loan origination production again and are reinstating most of our pre-COVID lending guidelines.

This quarter we also launched our first open preferred equity offering via a partnership with SeedInvest. Our stock price of $18.23, based on a valuation of $72.8 million, is yet another validation of the viability of our long term growth strategy and reflects an appreciation of your past equity investments in GROUNDFLOOR. As we approach our first closing on this new round of financing, the campaign has already raised nearly $1.7 million in just 6 weeks.

ДОПОЛНЕНИЕ от 12 августа 2020:

Компания GROUNDFLOOR была признана журналом Inc. Magazine одной из самых быстрорастущих частных компаний в Америке.

GROUNDFLOOR was ranked in the top 10% of companies on the 2020 Inc. 5000 list and the fastest-growing private financial services company in Georgia with an impressive growth rate of 1,141%.

ДОПОЛНЕНИЕ от 6 июня 2020: финансовые результаты за Q1 2020.

We are pleased to share the results from the first quarter of this year. The first quarter is typically soft for real estate transactions. Despite seasonal headwinds and the economic crisis brought on by the COVID-19 pandemic, we achieved significant growth and even set a number of investment records this quarter. Here are a few highlights:

We are pleased to share the results from the first quarter of this year. The first quarter is typically soft for real estate transactions. Despite seasonal headwinds and the economic crisis brought on by the COVID-19 pandemic, we achieved significant growth and even set a number of investment records this quarter. Here are a few highlights:

- We achieved 63% revenue growth compared to the same period one year ago, bringing our trailing 12-month revenue to $6.95 million, the most in our history.

- Investment volume grew 44% compared to Q1 2019 and we achieved our second biggest investment quarter ever, only behind our record-setting Q4 of last year.

- We set a record for GROUNDFLOOR Notes sales in March at $4.5 million, a 246% increase vs. Q1 2019.

- On the heels of our $3.7 million convertible debt raise in Q4, our Q1 limited equity raise resulted in $538,720 from 467 investors.

- Our borrowers submitted 333 paid loan applications and we originated 171 loans for over $28.5 million.

While the quarter overall was one marked by continued achievement and growth, many of our customers and our extended families have been impacted by COVID-19 personally, professionally, and fiscally. In the financial world, markets have experienced extreme volatility and treasury bond rates dropped to unprecedented lows. As the situation has progressed, we have been intentional in our decision to be forthcoming about our performance and the potential impact on our business and your investments. In that light, we have included an addendum to our update with answers to questions we’ve received from our Shareholder community about how the crisis is impacting GROUNDFLOOR.

ДОПОЛНЕНИЕ от 15 октября 2019: Интригующие новости! GROUNDFLOOR открыт для инвесторов со всего мира.

GROUNDFLOOR: Мы рады сообщить, что расширили нашу инвестиционную платформу для привлечения международных инвесторов. Теперь каждый может получить доступ к доходам, которые может предоставить недвижимость, даже если он не живет в США.

GROUNDFLOOR GOES GLOBAL: INTRODUCING INTERNATIONAL ACCOUNTS

Exciting news! We are pleased to announce we have expanded our investment platform to accommodate international investors. Now, everyone can access the high returns real estate can provide — even if they do not live in the US.

GROUNDFLOOR — это рыночная площадка инвестиций в недвижимость, который открыт как для неаккредитованных, так и для аккредитованных инвесторов, которые могут инвестировать в краткосрочные (6 — 12 месяцев) высокодоходные (6.5% -14%) займы, обеспеченные недвижимостью.

— Минимальная сумма займа — $10.

— Займы обеспечены залогом недвижимости.

— Перед предложением инвесторам каждый заем предварительно финансируется GROUNDFLOOR после тщательной проверки опыта заемщика, его кредитоспособности и бизнес-плана, а также оценки стоимости имущества «как есть» и «как улучшено» (as-is and as-improved).

— GROUNDFLOOR одобряет только 5% ссуд, которые они просматривают, и они настолько уверены в своих стандартах оценки, что предварительно финансируют сами большинство ссуд, которые они предлагают.

— Как только кредит полностью профинансирован, заемщик получает деньги в соответствии с графиком и использует эти средства для завершения проекта реконструкции.

— Вы сами решаете: когда, сколько и в какие объекты вкладывать свои деньги, начиная с инвестиций всего в 10 долларов

— При завершении срока проекта заемщик выплачивает инвесторам средства через Groundfloor, и единовременная сумма вложенных основных средств плюс полученные проценты зачисляется на ваш счет инвестора в GROUNDFLOOR.

— Баланс на вашем счете инвестора в GROUNDFLOOR может быть снят или реинвестирован в другие обьекты недвижимости.

— Типовые кредиты имеют доходность около 10% годовых на срок от 6 до 12 месяцев.

— Счета для инвесторов открываются и обслучиваются бесплатно.

Получите бонус в размере $ 10 за участие в программе GROUNDFLOOR : просто перейдите по ссылке в оранжевом блоке (ниже) на получение $10 бонуса за участие в программе GROUNDFLOOR, создайте бесплатную учетную запись инвестора, свяжите свою банковскую учетную запись и пополните свой новый счет в программе GROUNDFLOOR с минимальной суммой в $10 долларов.

Для более детального ознакомления ниже приводится письмо инвесторам (English only), в котором вы можете увидеть:

Результаты 2018 года и анализ диверсификации.